|

| |

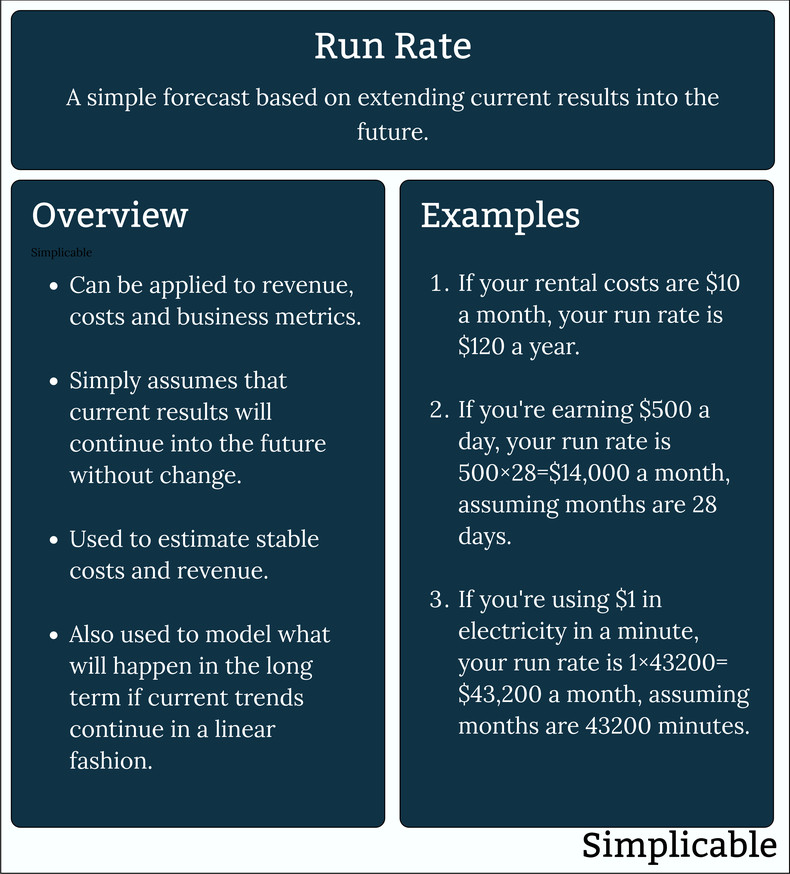

A run rate is a forecast based on extrapolating current results into the future. This can be applied to revenue, cost, financial and operational metrics to approximate future results. The following are illustrative examples.

Annual Run RateIt is common for firms to calculate an annual run rate for revenue based on the most recent quarter. This is useful when a firm is growing such historical results aren't as useful as the most recent quarter in estimating next year's revenue. For example, a firm that produced $12 million gross revenue in the current quarter may calculate an annual run rate as follows.| Annual Run Rate | = quarterly revenue × 4 | | = $12 million × 4 | | = $48 million |

One-time RevenueA firm may exclude one-time revenue from its run rate to obtain a more conservative and realistic view of future revenue. For example, a firm generates $10 million in a quarter from recurring revenues and $40 million from a one-time project that is unlikely to recur. They exclude the one-time revenue to calculate run rate as:| Annual Run Rate | = quarterly recurring revenue × 4 | | = $10 million × 4 | | = $40 million |

Seasonal RevenueA company that has strong seasonal patterns in its revenue doesn't typically calculate a run rate based on the most recent quarter. For example, a retailer that generates 50% of its revenue in the months leading up to Christmas will base its run-rate on its trailing 12 months revenue of $30 million.| Annual Run Rate | = trailing 12 months revenue | | = $30 million |

Net RevenueRun rate can be used to estimate future profitability. For example, a delivery service that is growing quickly had $10 million in revenue and $8 million in expenses in the most recent month can calculate its net revenue run rate as:| Annual Run Rate (Net) | = (monthly revenue - monthly expenses) × 12 | | = ($10 million - $8 million) × 12 | | = $24 million |

CostsRun rate can be calculated for all costs incurred by a business or a particular category of cost. For example, an ecommerce company is considering launching its own delivery service. As part of the decision making process they calculate the run rate for delivery costs based on the most recent monthly cost of $56 million.| Annual Run Rate (Cost) | = monthly cost × 12 | | = $56 million × 12 | | = $672 million |

MetricsRun rate can be calculated for a wide range of financial or operational metrics that you want to estimate based on current results. For example, a procurement team estimates the amount of coffee they will need to order next year for office coffee services from the current monthly usage of 450 pounds of coffee.| Annual Run Rate (Coffee) | = current monthly usage × 12 | | = 450 pounds × 12 | | = 5,400 pounds |

SummaryA run rate is a future forecast that simply assumes current conditions continue into the future.|

Type | | Definition | An estimate based on extrapolating current results into the future. | Related Concepts | |

Next: Financial Analysis

More about financial analysis:

If you enjoyed this page, please consider bookmarking Simplicable.

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited.

View credits & copyrights or citation information for this page.

|