Positive Risk

Positive risk is the potential for gains due to action or inaction. This is the opposite of regular risk. People tend to think of risk and opportunity as being completely separate concepts. Professionals who work with risk are more likely to model both of these as risk. In this context, risk can be negative and positive. For example, it is common for investment banks to view the potential for unexpected investment losses as downside risk and the potential for unexpected gains as upside risk.Speculative Risks

Speculative risks are risks that are attached to a potential for reward. This is a normal type of risk. For example, crossing the street is a risk that may have rewards such as getting to school on time. Speculative risks can be contrasted with pure risks that have no potential for gain such as the risk of a fire in a house.Calculated Risk

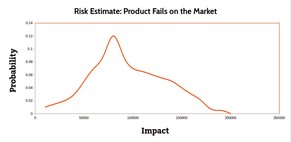

A calculated risk is a risk that is taken as a rational decision. This typically involves estimating the potential for loss and weighing this against the potential for gains. As a formal process this can be calculated and modeled using techniques such as risk-reward ratio.Risk Tolerance

Risk tolerance is the amount of risk that a society, organization, group or individual is comfortable taking on. For example, a retiree with zero tolerance for losing their savings such that they must settle for investments that are relatively safe but low return.Accepted Risk

In order for a risk to be "good" it must be accepted by those who are impacted by potential losses. Blindly taking uncalculated risks is generally a bad idea. Likewise, risks taken without informed consent are generally bad. For example, an investment advisor who takes excessive risks with a client's money without their knowledge.Managed Risk

People often incorrectly assume that risk should be minimized. In fact, it is almost never a good idea to minimize risk because this tends to be expensive, impractical and creates large secondary risks. For example, to minimize your accident risk it would be best to stay in bed but this creates large secondary risks such as health risks. As such, each risk is not minimized but managed -- this can include simply accepting risks or treating them.Fail Well

Fail well is the practice of designing things to fail quickly, cheaply and safety. This is a type of risk reduction that often occurs before risk management. In other words, risks can be designed-out as opposed to managed.Notes

Risk can build resilience as a person or organization learns from failures to become stronger. For example, a firm that launches 30 products a year with 90% failing may be more resilient than a firm that launches one product a year and needs it to succeed.Risk is an inescapable element of life such that avoiding risk only creates secondary risk.| Overview: Good Risk | ||

Type | ||

Definition | A risk that is attractive from the perspective of a society, organization or individual that it is taken in a calculated and managed way. | |

Related Concepts | ||