|

A-Z | Popular | Blog | Risk Management | Search » |

|

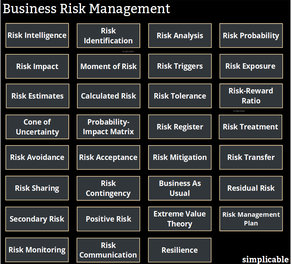

Risk Management  Risks

Key Concepts

Acceptable Risk  Risks

Related Topics

Business Risk Management  Cascading Failure vs Resilience  Enterprise Risk Management  Extreme Value Theory  Risk Analysis  Risk Communication  |

34 Examples of Insurance Fire InsuranceInsures against fire damage to structures and/or personal belongings.Homeowners InsuranceInsures against 3rd party liability, theft and damage to a home such as fire. Coverage often doesn't include all risks to a home such as floods and earthquakes.Flood InsuranceAs floods can impact a large number of homes this is a difficult thing to insure as billions in claims can occur from a single event. As such, flood insurance is often sold separately from homeowner insurance.Earthquake InsuranceCovers damage to property due to an earthquake. As with flood insurance, this may be excluded from standard homeowner's insurance. Often has a cap.Windstorm InsuranceCovers damage from hurricanes that may be excluded from homeowners insurance.Life InsuranceInsurance that pays out to a beneficiary when you die. Payment can also be triggered by terminal illness or critical illness. Often has exclusions such as war.Term Life InsuranceLife insurance that expires such that you will need new insurance, typically at a much more expensive rate, when you are older.Permanent Life InsuranceLife insurance that never expires such that you can carry it into old age. Payments are typically fixed and policies don't expire unless you let them lapse. Also known as whole life or universal life insurance.Accidental Death and Dismemberment InsuranceLife insurance that only pays out if the cause of death is an accident. In many cases, this is included in other types of insurance such as life insurance where there is a bigger benefit for accidental death.Burial InsuranceA limited type of life insurance that pays a relatively modest amount intended to cover funeral expenses.Unemployment InsuranceMandatory government insurance that provides some income if you become unemployed. Often doesn't cover quitting or refusal to work without good reason.AnnuityAn annuity is a financial product that pays you a fixed amount each month or year that you live. This is viewed as a type of insurance as it provides income stability thus reducing risk. An annuity can also be viewed as a type of investment that pays off if you live a long time.Liability InsuranceInsurance for legal claims against the insured. Often included in some limited way in other insurance. For example, home owners insurance that includes liability related to your property.Casualty InsuranceA broad term for liability insurance related to injury or damage to the property of others. This isn't usually sold separately but is included in things like car insurance and homeowner insurance.Professional Liability InsuranceInsures against legal claims related to your work. These products are specialized for a profession such as medical malpractice insurance.Fidelity BondInsures employers against dishonest acts by employees.Health InsuranceInsurance that covers medical expenses. It is common for nations to provide no cost or low cost health insurance to all residents or some subset of residents such as seniors and the disabled.Supplementary Health InsuranceSupplementary health insurance pays a lump sum if you get sick. This may pay different amounts for different diseases and/or may include a lump sum for each day you spend in hospital. This is very common in nations with national health insurance that doesn't cover 100% of costs.Extended Health PlansIn countries where healthcare is essentially free such that its funded with taxation, people may still purchase insurance known as extended health plans that cover things like prescription medications, dental care, physiotherapy, ambulance services and prescription eyeglasses.Disability InsuranceInsures income against disability that diminishes your capacity to earn a living.Workers CompensationA program of wage replacement and medical benefits that can be taken in lieu of a worker's right to sue their employer for a workplace injury.Vehicle InsuranceVehicle insurance primarily insures against third party liability for traffic accidents. This is typically mandatory, including minimum amounts that must be covered. Vehicle insurance may also insure your vehicle against damage or theft.Gap InsuranceCovers the total value of a vehicle in the case of a write off. Commonly offered by financing companies to customers leasing vehicles whereby the gap is between the value of the vehicle and the percentage of the vehicle actually owned by the lessee.Marine InsuranceVarious insurance related to boats and ships and their cargo.Aviation InsuranceCoverage for an aircraft you own including liability to passengers.Shipping InsuranceInsurance on the loss of goods in transit.Flight InsuranceLife insurance that only covers an incident on a flight. This is a remote possibility. Often offered with premium credit cards whereby coverage is activated by booking the flight with the card.WarrantyA guarantee regarding the quality of a product or service.Extended Warranties & Service ContractsAn upgraded warranty that has some cost. Often a dubious value. For example, an extended warranty on a $7 product such that the risk being insured is absurdly small. These are typically extremely profitable for the seller such that they may be aggressively marketed.Renters InsuranceCovers liability insurance and losses to the tenants personal property from fire, theft and other perils. May also cover expenses if your building becomes uninhabitable.Landlord InsuranceCovers a landlord's liability to tenants. Similar to homeowners insurance.Crop InsuranceInsures against various risks to crops such as disasters and weather. In some cases, these even protect against changes in market price. Crop insurance is typically funded by a government and represents a subsidy to agricultural companies or farmers.Social InsuranceA public insurance program that may cover risks to income such as sickness, disability, old age and unemployment. These are often partially or completely funded by mandatory employer and employee contributions.Social ProgramsGovernment services that resemble public funded insurance benefits in areas such as health and medical care, university education, housing, basic income, child benefits, pensions, disability pensions and workers compensation.NotesInsurance policies may include caps, deductions and exceptions such that coverage doesn't always cover your full risk of loss.Risk ManagementThis is the complete list of articles we have written about risk management.If you enjoyed this page, please consider bookmarking Simplicable.

Risk ManagementAn overview of the risk management process.

Enterprise Risk ManagementA complete overview of enterprise risk management with examples.

Enterprise Risk

A list of common enterprise risks.

Risk Management Plan

An overview of risk management plans with detailed examples.

Crisis Management Plan

Full examples of crisis management plans that can be used as a template.

Turnaround ManagementThe definition of turnaround management with examples.Negative Risk

The definition of negative risk with examples.

Internal Risks

The definition of internal risk with examples.

Business Impact

A list of business impacts.

Risk AnalysisA complete guide to risk analysis.Risk ProbabilityThe common ways to model risk probability.Qualitative Risk Analysis

A definition of qualitative risk analysis with an example.

Cost Of RiskA definition of cost of risk with examples.Risk Perception

A definition of risk perception with examples.

Risk vs Hazard

The difference between a risk and a hazard with examples.

Swot ThreatsA list of threats for SWOT analysis.What-if Analysis

The definition of what-if analysis with examples.

External Factors

A list of common external factors.

Risk ExposureA definition of risk exposure with example calculations.TrendingThe most popular articles on Simplicable in the past day.New ArticlesRecent posts or updates on Simplicable.

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited. View credits & copyrights or citation information for this page. |