Goals & Objectives

Rational choice theory assumes that people and the organizations they run are goal-oriented. It doesn't assume anything about the nature of these goals and objectives. However, it is common for individual models based on rational choice theory to make these assumptions. For example, the assumption that corporations seek net profits.Maximization & Minimization

Rational choice theory tends to assume that people maximize or minimize for their goals. This can be contrasted with practical behavior whereby people do the best they can without too much effort. For example, an individual who isn't trying to maximize their income but rather wants an easy way to support a particular lifestyle.Preferences

Rational choice theory assumes people develop a hierarchy of preferences in each decision making situation. People may have a strict preference, weak preference or be indifferent to each option. These preferences are assumed to be complete and transitive. For example, a consumer who scores every car in the market before buying a vehicle such that they can tell you exactly which they prefer and how much they prefer it.Logical Omniscience

In order to be rational, an individual needs to know all known truths, accept all known truths and apply all known truths to every situation. For example, a consumer with a goal to buy the most healthy muffin must know all the ingredients of the muffin, how each ingredient was cultivated and processed and the health impacts of all of this and be able to logically formulate this into an option of healthiness.Rational Expectations

Rational expectations is the assumption that people know about economic models, use them in their decision making and apply the results to decisions. For example, an individual choosing a floating rate mortgage would model inflation expectations and probable future interest rates.Perfect Information

It is common for models based on rational choice theory to assume that all economic agents have perfect information. For example, a small investor who knows as much about a firm as its CEO. As such, a model based on rational choice theory alone may ignore problems of uncertainty and information asymmetry.Expected Utility Hypothesis

The expected utility hypothesis is the extension of rational choice theory to deal with uncertainty. It states that people use the weighted average of probable outcomes to choose between options that involve uncertainty. The weights of outcomes are their probability. For example, a student who looks at the probability of different salary levels for the graduates of different majors to develop a weighted average salary for each major. This may be more practical than it sounds as in practice a government or school may publish this information.Information Cost

Rational choice theory doesn't account for information cost. For example, a small investor might have to spend six years investigating 12 hours a day to know as much about a company as its CEO.Discounting

Rational choice theory often deals with time by discounting future things to their present value. For example, a rational student choosing between majors might discount all their future salary potential to a present value if their goal is to maximize lifetime earnings.Instrumental Rationality

Instrument rationality is a model based on rational choice theory that assumes people choose the least costly path to a goal.Efficient Market Hypothesis

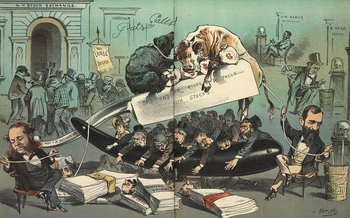

The efficient market hypothesis is a prominent example of a model based on rational choice theory. It states that the price of assets and securities perfectly reflect their risk-adjusted value at all times. In other words, markets such as stock markets are so competitive and rational that securities are never mispriced. This means that nobody can beat the market on a risk-adjusted basis with skill and anyone who does simply got lucky as they are a predictable statistical abnormality.Overview

Rational choice theory is the assumption underlying many well-accepted social and economic theories that people are fully rational and have access to perfect information at all times. In practice, rational choice theory also makes assumptions about the goals and motivations of people such as the assumption they try to maximize wealth, power, social status or health.

Notes

It is arbitrarily easy to prove that humans aren't completely rational with simple sociological observations or experiments. Rational choice theory doesn't necessarily claim that it is true that all humans are rational but rather uses the assumption that humans are rational in aggregate as a means of developing clear and falsifiable hypotheses. Rational choice theory allows models to use well-developed types of mathematics such as optimization theory. Competing assumptions such as bounded rationality require more complex math that deals with randomness, social signaling, herd behavior and heuristics.Rational choice theory can be viewed as an acceptance that humans are too complex in their choices to model accurately such they rationality is the best available approximation.In many cases, you don't need everyone to be rational to build valid models based on rational choice theory. For example, if a small percentage of investors are rational the predictions of efficient market theory are valid as these investors would quickly buy any stocks that are priced too low and short-sell stocks that are priced too high immediately correcting mispricing caused by noise traders.| Overview: Rational Choice Theory | ||

Type | ||

Definition | A framework for modeling social and economic behavior that assumes humans are logical such that they are goal-oriented, evaluative and consistent. | |

Related Concepts | ||