|

| |

A business risk is a future possibility that may prevent you from achieving a business goal. The risks facing a typical business are broad and include things that you can control such as your strategy and things beyond your control such as the global economy. The following are common types of business risk.Accounting Risk | Acquisition Risk | Audit Risk | Brand Risk | Budget Risk | Business Continuity Risk | Capacity Risk | Cash Flow Risk | Commodity Risk | Competition Risk | Compliance Risk | Concentration Risk | Contract Risk | Cost Risk | Counterparty Risk | Country Risk | Credit Risk | Currency Risk | Customer Risk | Cybersecurity Risk | Demand Risk | Disaster Recovery Risk | Economic Risk | Environmental Risk | Estimate Risk | Exchange Rate Risk | Facility Risk | Financial Risk | Financing Risk | Fraud Risk | Health & Safety Risk | Inflation Risk | Information Technology Risk | Infrastructure Risk | Intellectual Property Risk | Interest Rate Risk | Inventory Risk | Knowledge Risk | Legal Risk | Liquidity Risk | Market Risk | Marketing Risk | Operational Risk | Outsourcing Risk | Partner Risk | Platform Risk | Political Risk | Price Risk | Process Risk | Procurement Risk | Product Liability Risk | Product Risk | Project Risk | Quality Risk | Recession Risk | Recruiting Risk | Refinancing Risk | Regulatory Risk | Reputational Risk | Requirements Risk | Resource Risk | Revenue Risk | Sales Risk | Schedule Risk | Seasonal Risk | Service Risk | Social Responsibility Risk | Strategic Risk | Succession Risk | Supplier Risk | Supply Chain Risk | Taxation Risk | Technological Disruption | Weather Risk |

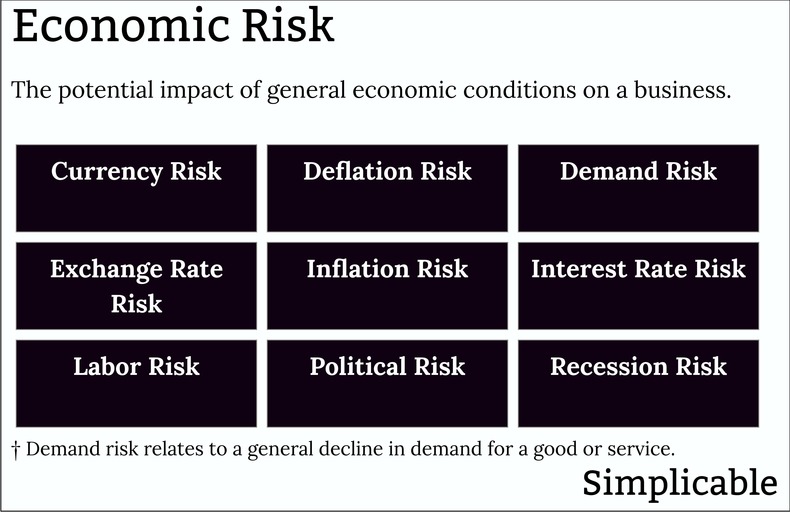

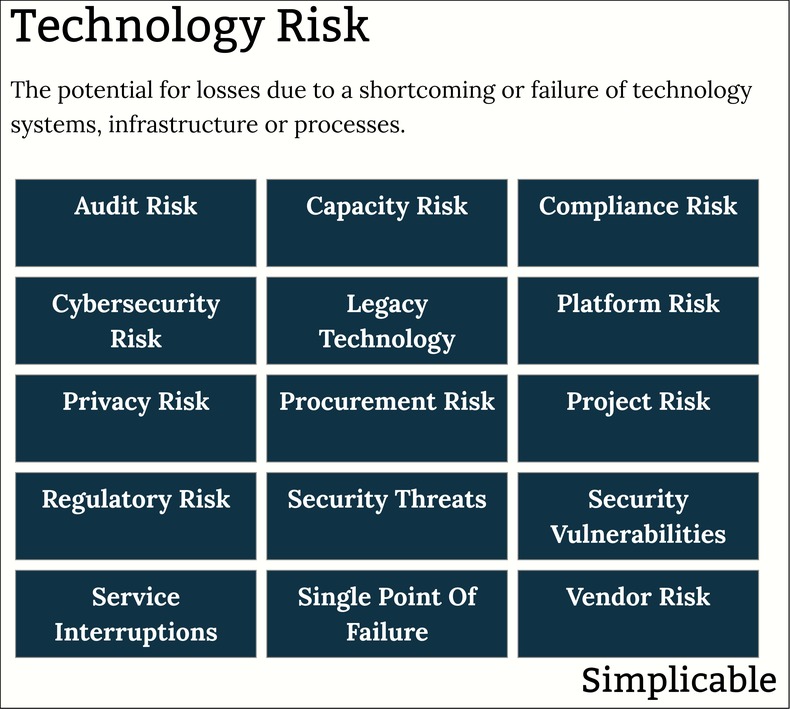

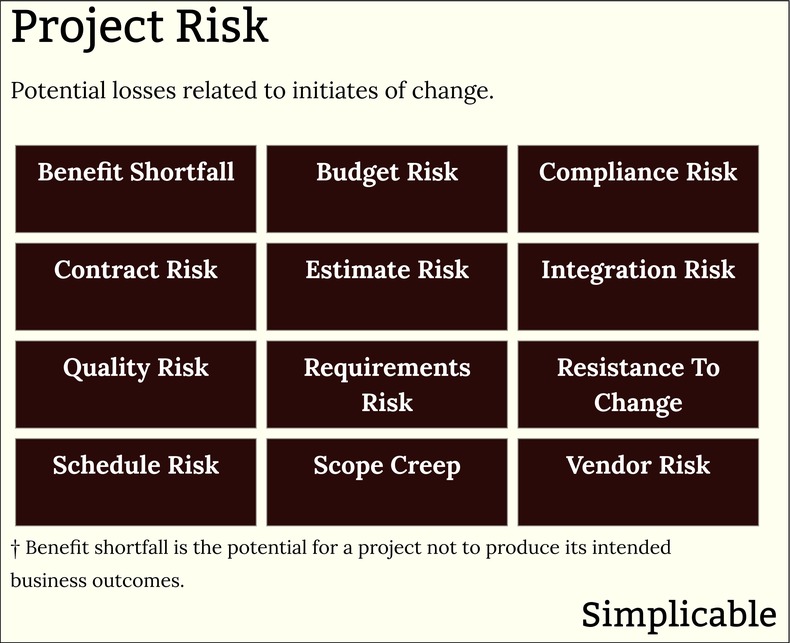

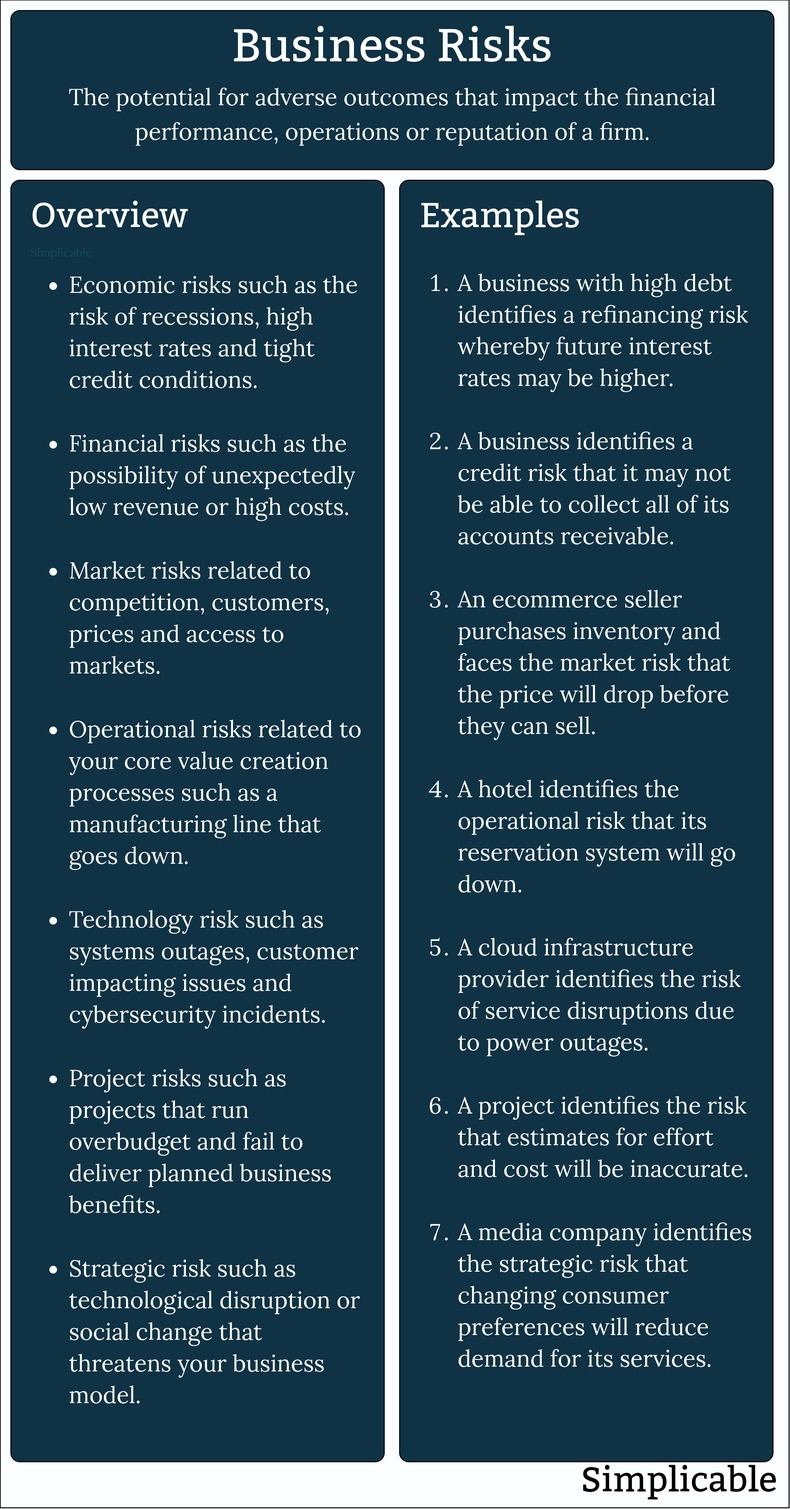

Economic RiskThe possibility that general conditions in the economy will increase your costs, reduce your sales or disrupt your operations.Financial RisksRisks to a firm's financial health such as the risk of running out of the cash required to meet your current obligations.Market RiskRisks related to market conditions such as customers, competition and pricing.Operational RiskOperational risk is the potential for failure related to your core value creation processes. For example, if you are a hotel this would be risk to your facility management and customer service processes.Technology RiskThe potential for losses due to technology shortcomings or failures. This prominently includes technology outages that impact operations and revenue. Technology risk also includes cybersecurity risk and compliance risks.Project RiskRisks to projects such as schedule, budget and quality risks. Project risks also include the potential for projects to cause operational disruptions or other business problems such as customer attrition.Strategic RiskRisk to a business's goals, objectives and plans. This includes immediate risks such as competition and long term social, cultural and technological change that may derail a firm's business model or viability.OverviewA business risk is the potential for any unplanned or unexpected outcome that negatively impacts a business. SummaryThe following are common types of business risk that can impact the financial performance, operations and brand value of a firm. DiscussionCompetitive risk is the potential that your competition will gain advantages over you that prevent you from reaching your goals. For example, competitors that have a fundamentally cheaper cost base or a better product.Regulatory risk is the chance that new regulations will disrupt your business or that you will incur expenses and losses due to compliance costs.Compliance risk is the chance that you will violate regulations. In many cases, a business may fully intend to follow the law but ends up violating regulations due to oversights or errors.Country risk is your exposure to the conditions in the countries in which you operate such as political events and the economy.Quality risk is the potential that you will fail to meet your quality goals for your products, services and business practices.Credit risk is the risk that those who owe you money to fail to pay. For the majority of businesses this is mostly related to accounts receivable risk.Exchange rate risk relates to volatility in foreign exchange rates. Many global businesses have high exposure to a basket of currencies that can add volatility to financial results such as operating margins.Interest rate risk is the chance that changes to interest rates will disrupt your business. For example, interest rates may increase your cost of capital thus impacting your business model and profitability.Taxation risk is the potential for new tax laws or interpretations to result in higher than expected taxation. In some cases, new tax laws can completely disrupt the business model of an industry.Process risks are the business risks associated with a particular process.Resource risk is the chance that you will fail to meet business goals due to a lack of resources such as financing or the labor of skilled workers.Political risk is the potential for political events and outcomes to impede your business. Seasonal risk is a business with revenue that's concentrated in a single season such as a ski resort. Risk vs RewardThere is a strong relationship between risk and reward. It's generally impossible to achieve business gains without taking on at least some risk. Therefore, the purpose of risk management isn't to completely eliminate risk. In most cases, risk management seeks to optimize the risk-reward ratio within the bounds of the risk tolerance of your business. Next: Risk Management

More about business risks:

If you enjoyed this page, please consider bookmarking Simplicable.

An overview of competitive risk.

A list of common types of financial risk.

A list of common investment risks.

The definition of legal risk with examples.

The definition of operational risk with examples.

An overview of passive risk.

The definition of political risk with examples.

The probability that you will fail to meet a goal due to a lack of resources such as skilled workers or financing.

The definition of strategic risk with examples.

TrendingThe most popular articles on Simplicable in the past day.

Recent posts or updates on Simplicable.

Site Map

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited.

View credits & copyrights or citation information for this page.

|