Inherent Risk

The possibility that a firm has misstated its financial results, performance or position.Business Model

A business model that isn't sustainable such as a small firm that is buying growth that it can't scale.Business Risk

A business risk that may cause the current or future earnings of the firm to decline.Financial Risk

Financial risks that face the firm such as liquidity risk.Business Cycle

A turn in the business cycle of an industry. For example, oversupply that leads to declining margins that impacts an entire industry for an extended period of time.Volatility

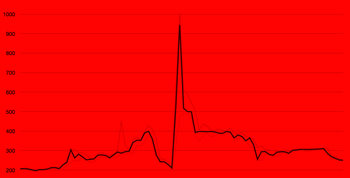

Volatility in the price of the asset. For example, price swings in a small cap stock based on rumors or reactions to news.Reputation

Loss of investor and customer confidence in the management or culture of the firm based on behavior and performance.| Overview: Price Risk | ||

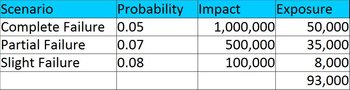

Type | ||

Definition | The potential for the decline in the price of an asset or security relative to the rest of the market. | |

Related Concepts | ||