Prices

Declining prices due to competition and market forces such as commodity prices.Operational Risk

Operational risks such as a supply chain disruption that results in reduced supply of your products.Information Security

An information security incident that disrupts your services or marketing channels.Distribution

Distribution issues such as a dispute with a channel partner that leads to decreased sales in a particular region.Promotion

A promotional campaign such as a catalog mailing that doesn't achieve what you expect.Sales

Sales problems such as an unpopular incentive plan that causes several top performers to leave your sales team.Customer Churn

Customer attrition due to customer satisfaction issues or competition.Brand Risk

Brand related risks such as declining brand awareness and recognition.Reputation

Reputational risks such as a hotel that receives bad publicity due to a customer service incident. This causes declining reviews, rankings and bookings.Concentration Risk

Concentration risk a lack of product or customer diversification. For example, a firm that generates 40% of its revenue from a single customer.Economic Risk

An economic downturn that causes customers to cut back on spending.Exchange Rate Risk

The value of foreign sales can decline due to exchange rate fluctuations. Such fluctuations can also make your products less cost competitive in foreign markets.Trade Barriers

Tariffs and other trade barriers that reduce your global sales.Political Risk

Political risks that disrupt your operations or sales.Product Development

Product development risk such as a failed or poorly received product launch.Competition

Competition such as an innovative new product that causes a sharp decline in demand for your products.Market Fit

Shifting customer needs or preferences that reduce demand for your products or services.Seasonal Risk

Firms that generate most of their sales in a particular season are exposed to disruptions that occur in that season such as poor weather.Bankability

Changes to your bankability such as liquidity problems that make customers less likely to close deals.Accounts Receivable

Difficulty in collecting revenue.Force Majeure

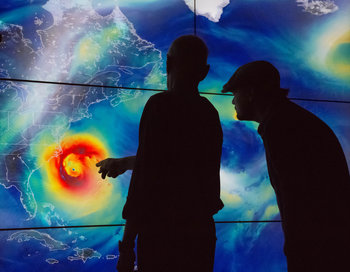

A large scale negative event over which you have no control such as a hurricane.| Overview: Revenue Risk | ||

Type | ||

Definition | A potential event or condition that negatively impacts your future revenue. | |

Related Concepts | ||