|

| |

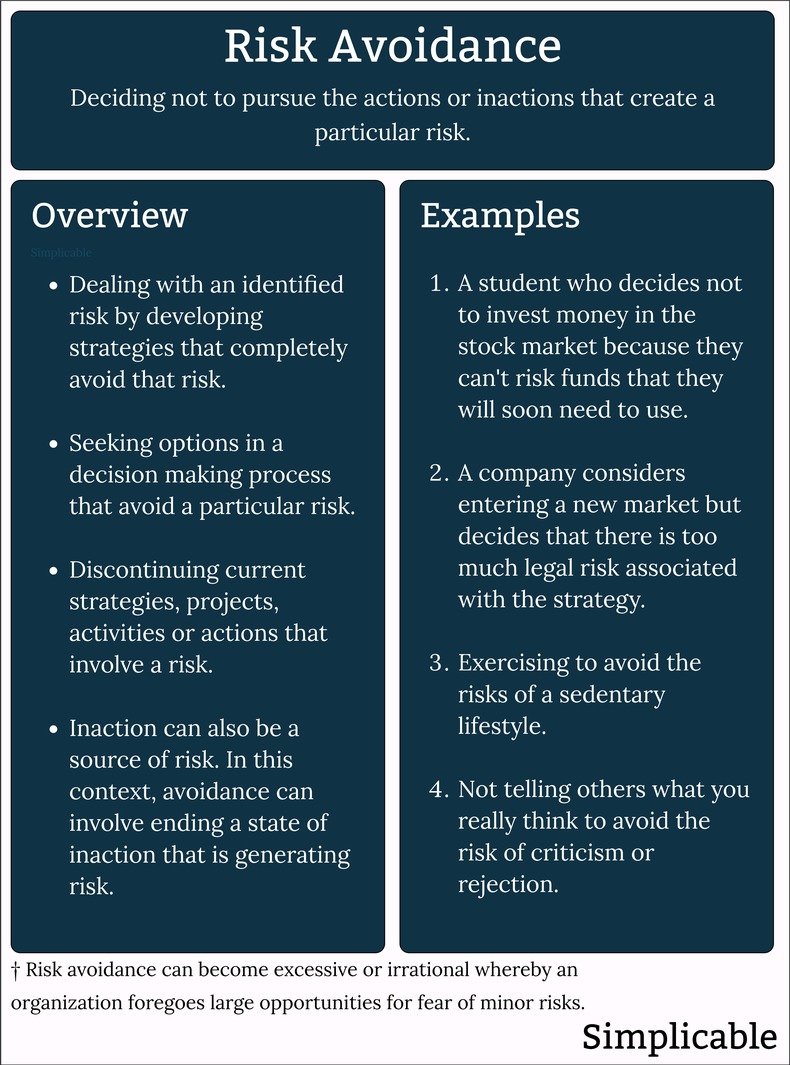

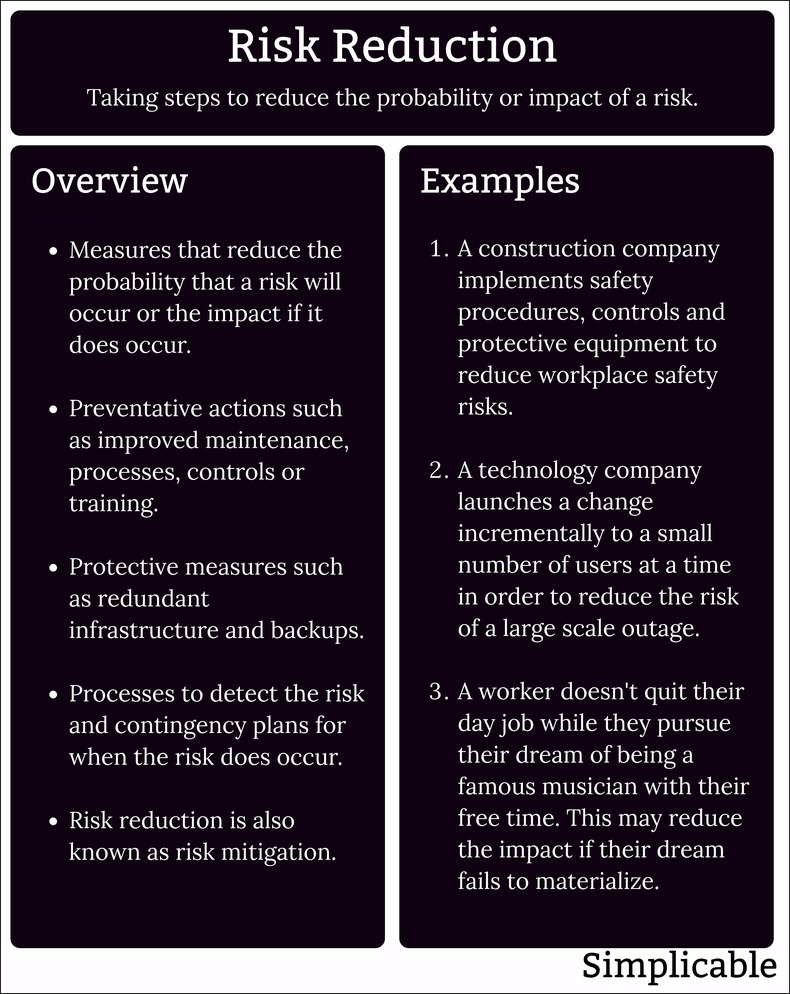

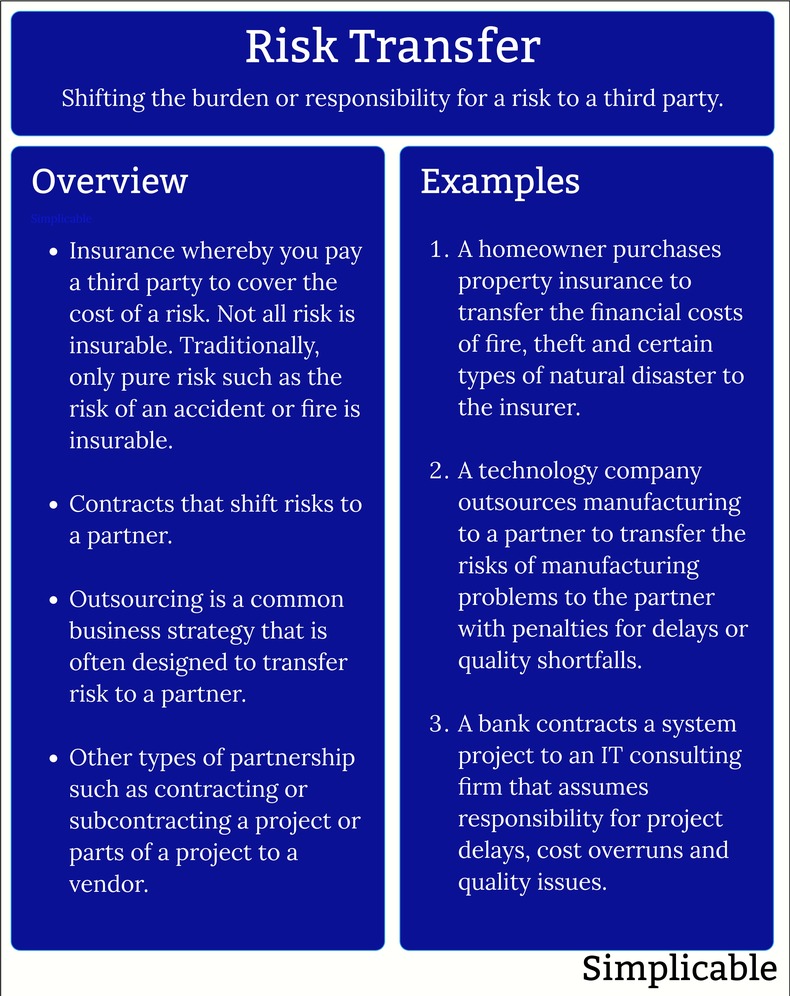

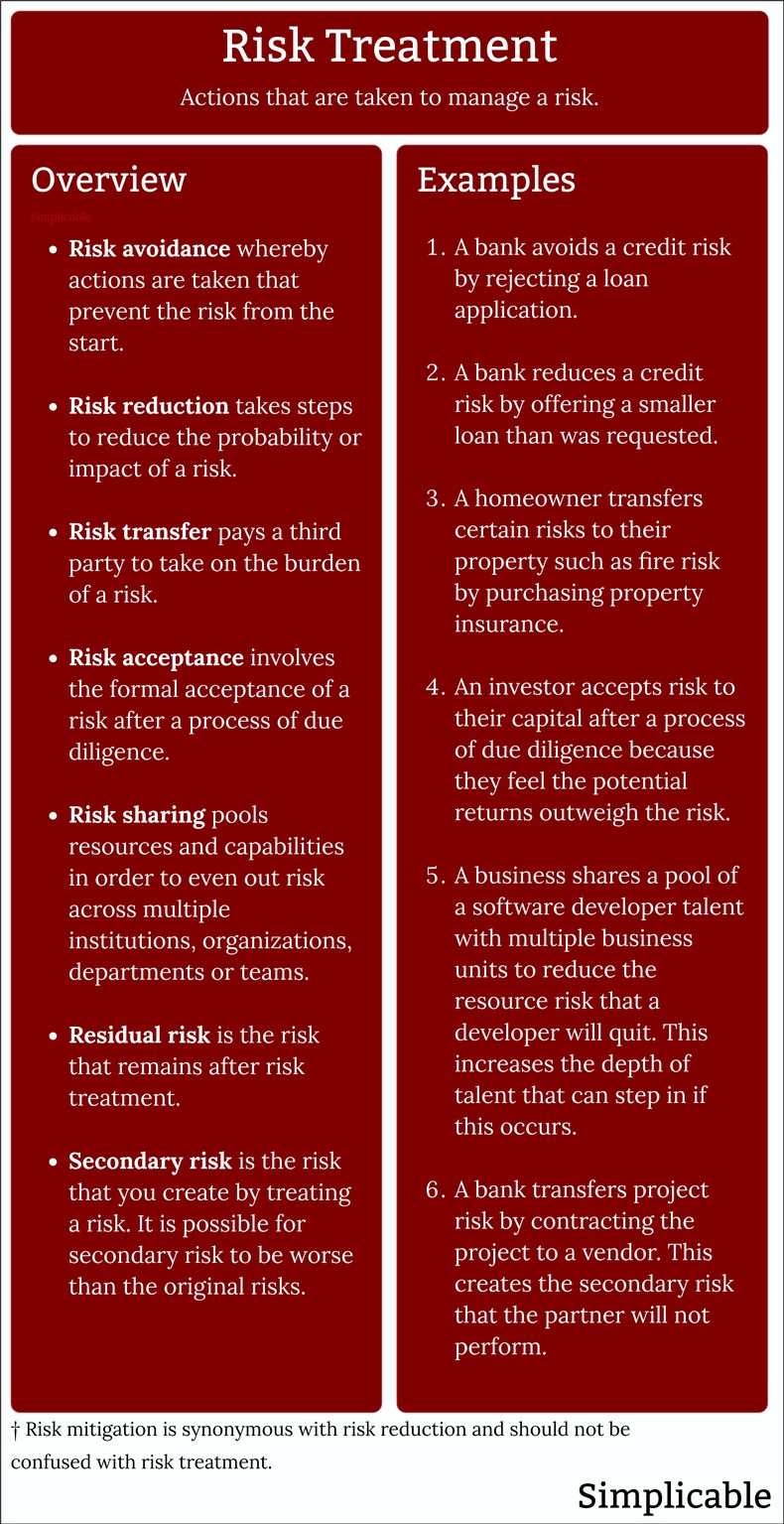

A risk treatment is an action that is taken to manage a risk. Risk management processes all include steps to identify, assesses and then treat risks. In general, there are five types of risk treatment:1. AvoidanceYou can choose not to take on the risk by avoiding the actions that cause the risk. For example, if you feel that swimming is too dangerous you can avoid the risk by not swimming.2. ReductionYou can take mitigation actions that reduce the risk. For example, wearing a life jacket when you swim.3. TransferYou can transfer all or part of the risk to a third party. The two main types of transfer are insurance and outsourcing. For example, a company may choose to transfer a collection of project risks by outsourcing the project.

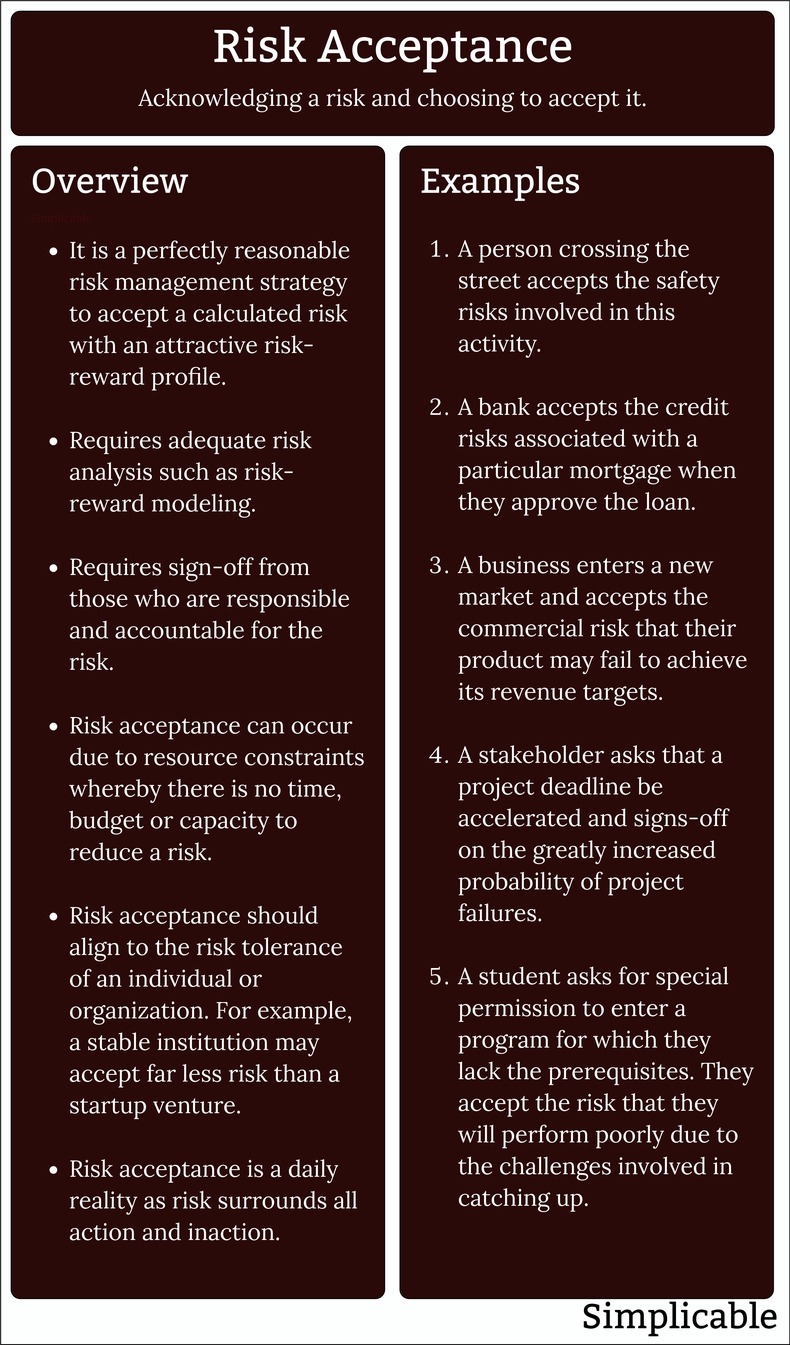

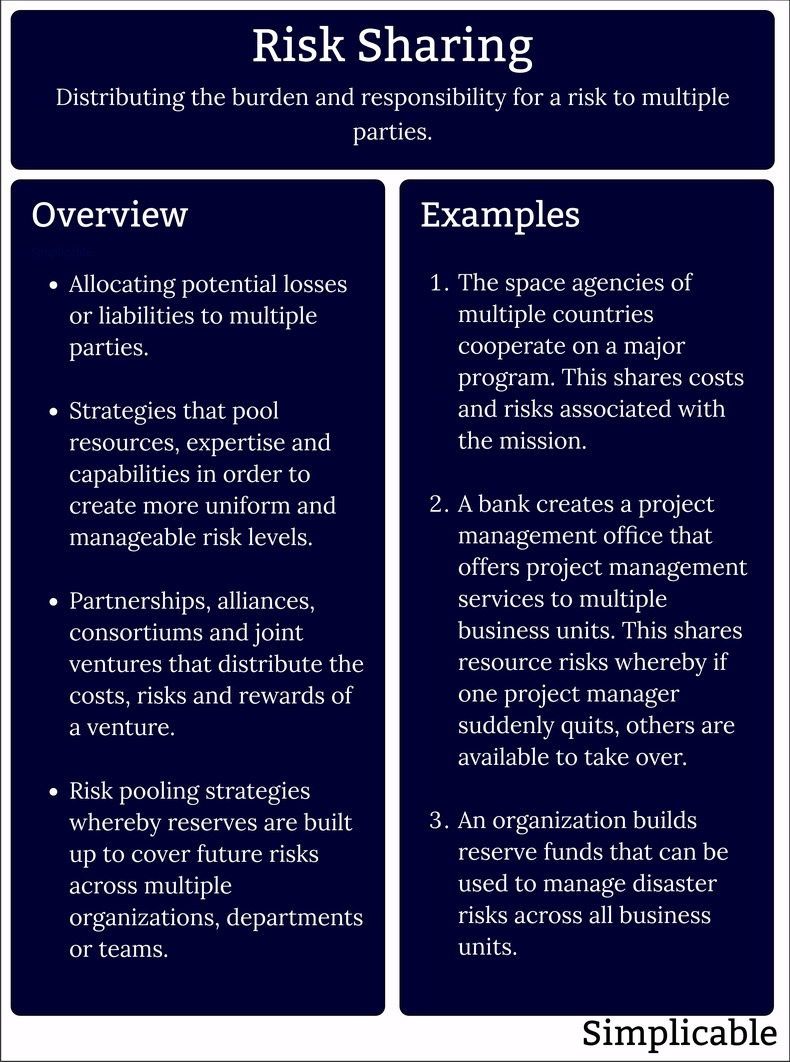

4. AcceptanceRisk acceptance, also known as risk retention, is choosing to face a risk. In general, it is impossible to profit in business or enjoy an active life without choosing to take on risk. For example, an investor may accept the risk that a company will go bankrupt when they purchase its bonds.5. SharingRisk sharing is the distribution of risk to multiple organizations or individuals. This is done for a variety of reasons including insurance products and self-insurance strategies.Residual RiskRisk treatments don't necessarily reduce risks to zero. Remaining risk after treatment is known as residual risk. Secondary RiskIt's common for your efforts to reduce risk to have risks of their own. These are known as secondary risks. For example, if you outsource a project you will assume a number of secondary risks such as the risk that the outsourcing company will fail to deliver.SummaryRisk treatment is any action that is taken to manage a risk. This includes risk acceptance whereby nothing is done to reduce the risk after a process of due diligence and sign off.Next: Risk Mitigation

More about risk treatment:

If you enjoyed this page, please consider bookmarking Simplicable.

A list of common risk controls.

A list of techniques for reducing risk.

An overview of the risk management process.

An overview of cascading failure and resilience.

An overview of business as usual.

The difference between risk mitigation and risk reduction.

A definition of risk value with example calculation.

The common types of risk impact.

A definition of risk communication with examples.

Overview of the steps in a risk management process.

A list of common business risks.

A metric for measuring risk management.

The potential that you'll achieve too much of a good thing.

Any risk that people have a strong aversion too.

The definition of risk taking with examples.

A list of risk examples by type.

The two main factors in modeling a risk.

A definition of calculated risk with an example.

How to calculate relative risk with examples.

TrendingThe most popular articles on Simplicable in the past day.

Recent posts or updates on Simplicable.

Site Map

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited.

View credits & copyrights or citation information for this page.

|