Investment

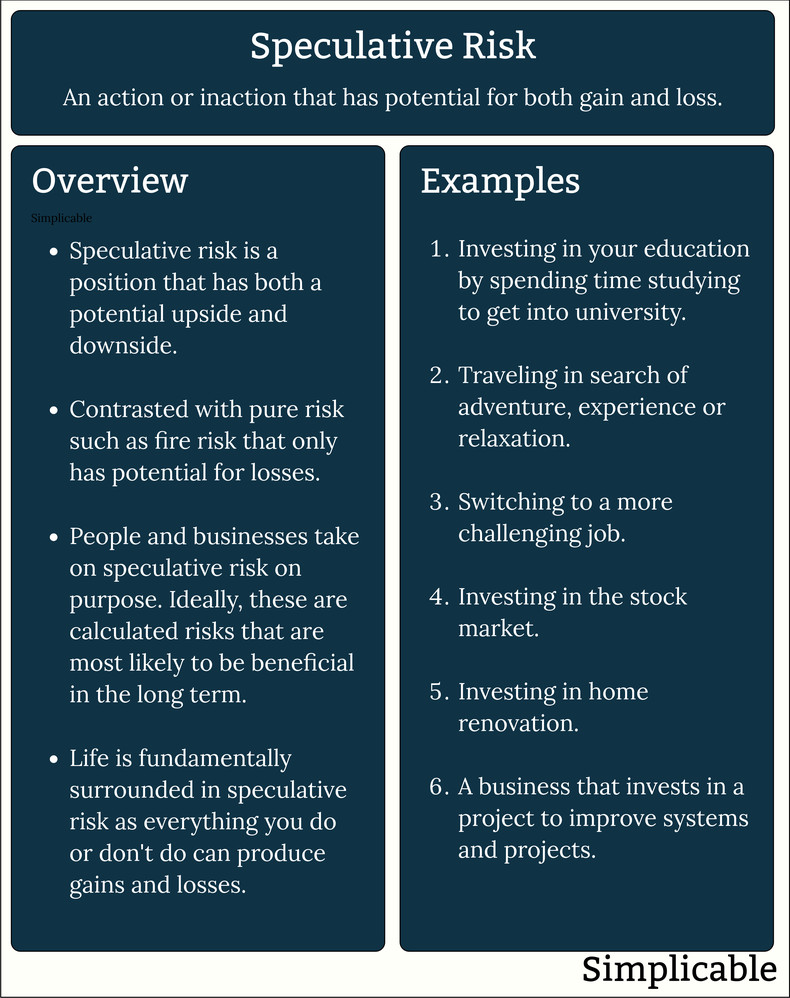

Investing resources in productive pursuits such as a business, asset or property that generates value. This is the basis for economic production. For example, a pension fund that invests in companies that employee people and produce products and services. Almost every type of investment has some type of risk attached to it. Generally speaking, higher risk investments also provide some probability of higher rewards. It is common for investors to view everything as risk with the probability of gains known as a positive risk, or upside risk.Speculation

The term speculative risk has nothing to do with speculation except that speculation is one form of speculative risk. Speculation is a gambling activity or investment that produces no value such that it is a zero-sum game. This tends to be higher risk because, unlike investors, speculators produce no value such that the probability of losses tends to be higher than the probability of gains. For example, buying a foreign currency because you predict its value will increase is a type of speculation. In an efficient market, it is unlikely you will win at this and will eventually lose your capital due to transaction costs.Business

Almost everything that a business does can be viewed as a speculative risk from hiring an employee to launching a new product. Likewise, day-to-day operational processes are essentially repeated processes of speculative risk taking. For example, a production line that may create products that generate revenue or may experience expensive outages on any given day.Entrepreneurship

Starting a new business based on new idea such as a unique product or business model is an especially high risk, high reward type of business activity. Entrepreneurial ventures often completely fail. In the rare cases that they succeed, they may produce superior investment returns for early investors.Quality of Life

Anything that you do to improve your quality of life such as getting an education, taking a trip, accepting a job, buying a house, making friends or getting married carries potential of both gains and losses and is therefore a speculative risk. Everyday acts such as eating a meal or walking to work are also extremely minor speculative risks.Doing Nothing

Inaction can be as risky as action and tends to be a type of speculative risk. For example, staying in a job for a long time may appear to be risk avoidance but could be a form of risk taking if you have become complacent while your skills and abilities are becoming less marketable.Summary

Speculative risk is the potential for losses or gains related to action or inaction. This can be contrasted with regular risk, known as pure risk, that is a potential for losses.

| Overview: Speculative Risk | ||

Type | ||

Definition | Action or inaction that has potential for both gain and loss. | |

Opposite of | ||

Related Concepts | ||