|

| |

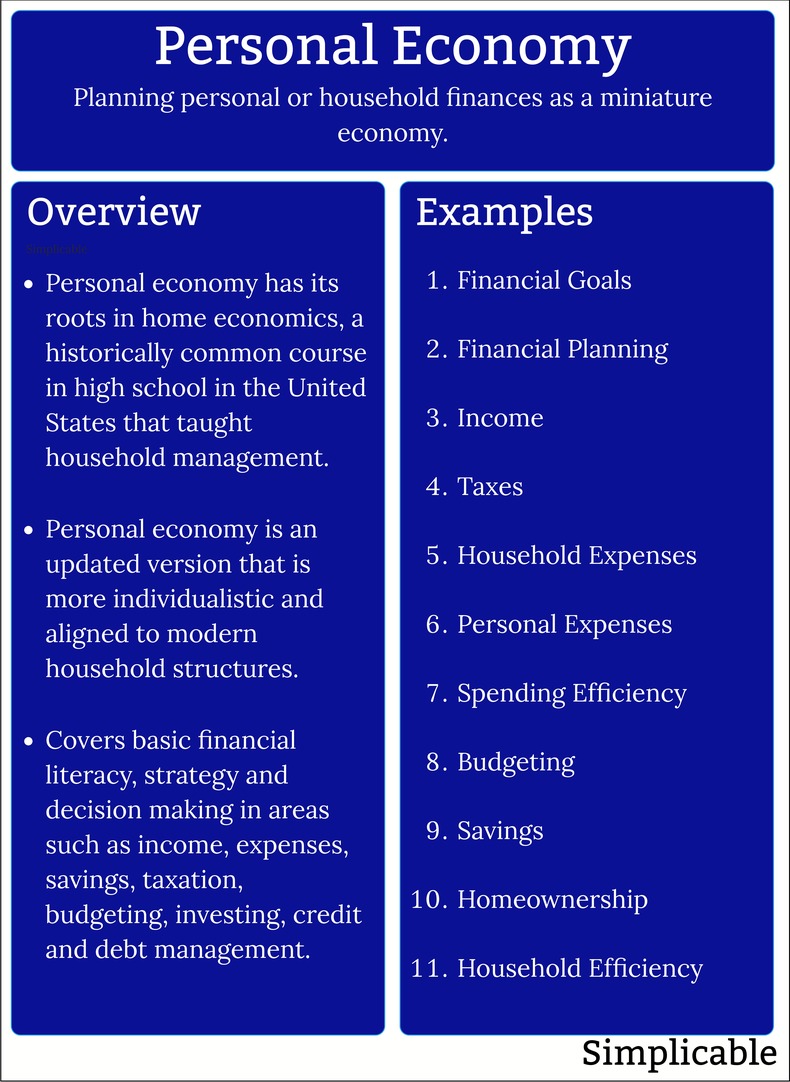

Personal economy is the practice of viewing your finances as an economic system. A personal economy is perhaps an intriguing way to think of your economic life whereby you create value, capture value and put it to work to live your life and save for the future. The following are common elements of a personal economy.

Budgeting | Business Ventures | Career Plan | Charitable Giving | Credit & Credit Score | Debt | Education Savings | Emergency Fund | Employment | Estate Planning | Family Businesses | Family Support | Financial Decisions | Financial Goals | Financial Planning | Generational Wealth | Homeownership | Household Efficiency | Household Expenses | Income | Insurance | Investments | Net Worth | Personal Expenses | Retirement Plan | Risk Tolerance | Savings | Side Hustles | Spending Efficiency | Spending Habits | Taxes | Unplanned Financial Events |

SummaryThe practice of thinking of your personal economic life as a small economy. This may be an interesting perspective for personal planning and budgeting.DiscussionPersonal economy has its roots in home economics, a historically common course in high school in the United States that taught household management, family budgeting and consumer economics alongside practical skills in areas such as cooking, sewing and childcare.Next: Personal Economic Life

More about economic life:

If you enjoyed this page, please consider bookmarking Simplicable.

An overview of personal economic life with examples.

The definition of play with examples.

A list of reasons that families are important.

TrendingThe most popular articles on Simplicable in the past day.

Recent posts or updates on Simplicable.

Site Map

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited.

View credits & copyrights or citation information for this page.

|