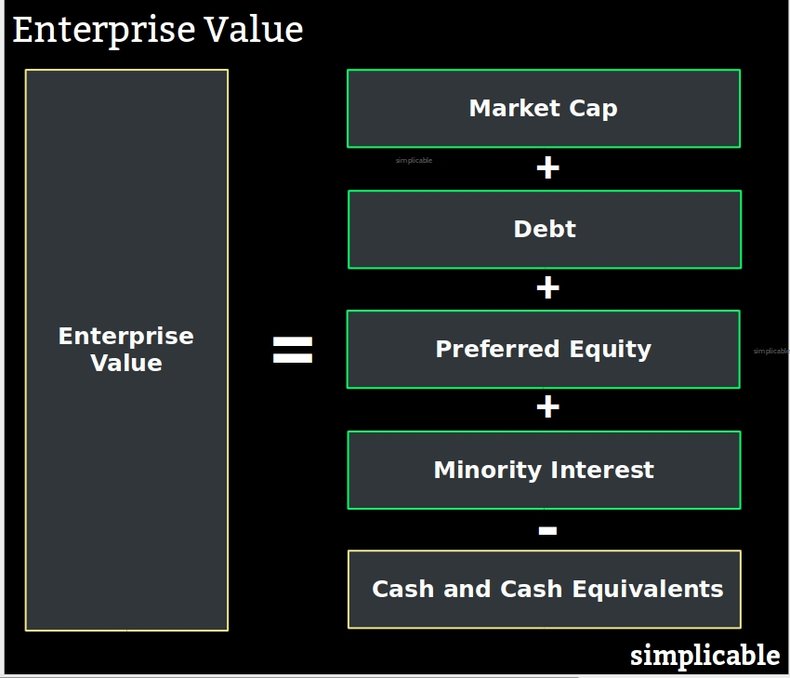

Calculation

Enterprise value is calculated as the market cap of a firm plus preferred equity, minority interest and debt minus cash and cash equivalents.

Example #1

A firm with no debt and cash equivalents of $50 billion has a market cap of $200 billion. EV = $200 billion + 0 + 0 + 0 - $50 billion = $150 billionThis firm has enough cash that it begins to play a significant role in the valuation of the firm. For example, this firm may have a higher PE ratio than peers that have little cash and considerable debt.Example #2

A firm with $10 billion debt, $1 billion in market cap and $10 million in cash.EV = $1 billion + $10 billion - $10 million = $10.99 billionThis firm is in financial distress because its debt is far greater than its market cap.Enterprise Value to EBITDA

Enterprise value is often used to calculate an earnings multiple using EBITDA, or earnings before interest, taxes, depreciation and amortization. This is based on the following formula.EV to EBITDA = Enterprise Value/EBITDA For example a firm with an enterprise value of $150 billion and EBITDA of $10 billion: EV to EBITDA = 150/10 = 15 In many cases, this is more useful than a price-to-earnings multiple because it considers the impact of debt.Enterprise Value to Sales

Another common multiple based on enterprise value is EV to Sales. This is based on total revenue as follows:EV to Sales = Enterprise Value/Total Revenue For example, a firm with an enterprise value of $200 billion and total revenue of $100 billion:EV to Sales = 200/100 = 2This is generally more useful than a price-to-sales multiple because it considers cash position and debt.| Overview: Enterprise Value | ||

Type | ||

Definition | The total price that you would have to pay to buy a firm at a point in time. | |

Related Concepts | ||