Intrinsic Value

Intrinsic value is the sum of all future earnings of a firm discounted to present value. This requires conservative estimates of earnings and growth rate.Margin of Safety

A margin of safety is when you are able to purchase a stock below its intrinsic value. This provides some protection against the risk that future earnings will be disappointing. Margin of safety is calculated as the difference between price and intrinsic value.Defensive Pessimism

Value investing requires a healthy degree of defensive pessimism to determine a realistic intrinsic value for stocks. For example, an experienced value investor may believe that a small firm with a high growth rate will be unlikely to maintain that growth rate as it grows larger.Contrarian Mindset

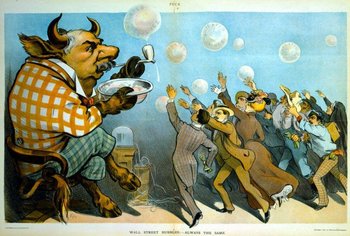

Generally speaking, popular stocks never sell at a price that offers a margin of safety. As such, value investing requires independent thinking that is able to see value in a firm that is disliked by the crowd.Mr Market

Mr. Market is an analogy associated with value investing. It suggests that the market is a moody fellow who is euphoric one day and depressed the next. He is reasonably efficient but sometimes offers prices that are wildly inflated or cheap. The goal of value investing is to buy when Mr Market is depressed and offering prices that represent a margin of safety.Gapp vs Non-Gapp

Generally accepted accounting principles, or GAPP, are a set of accounting standards that must be used to report the earnings of public companies in many jurisdictions. Companies tend to prefer non-GAPP reporting as they would prefer to exclude costs such as certain types of executive compensation. Value investors tend to focus on GAPP numbers. For example, a value investor may subtract "one time charges" from earnings numbers. Value investors may be suspicious of firms that are too creative with their non-GAPP accounting. They may be attracted to firms that report GAPP earnings without any attempt to inflate numbers with non-GAPP.Risk

Value investors may look for situations where risks to a firm have been over-estimated. Depending on market conditions, stocks priced with a margin of safety may be rare. As such, stocks with a low price are often facing a number of risks. Value investors often need to understand these risks to avoid a value trap.Value Trap

A value trap is a stock that has an attractive financial metric such as a low price-to-earnings ratio or high dividend yield that makes it appear as a value until you investigate factors such as debt or risk that make its intrinsic value quite low.Inherent Risk

Inherent risk is the risk that management is hiding something or overstating results. Value investors tend to be exposed to inherent risk as they seek firms with unusually good numbers that the market has priced low. As such, value investing requires a great deal of research into the management and risks surrounding a firm.Corporate Governance

Value investors may consider the risk that insiders will take a firm's profits for themselves through executive compensation or other techniques such as selling assets to insiders at a low price. Assessing this risk requires analysis of the structure of a firm's corporate governance and the reputation of management.Financial Health

Beyond basic metrics such as trailing price-to-earnings and book-value-per-share, a value investor will investigate the financial health of a firm including debt, cash and accounts receivable. They will consider the growth in shareholders equity per share as opposed to growth in the firm as a whole. In other words, they will detect firms that have grown revenue by printing shares.Benjamin Graham Formula

Benjamin Graham was a professor of Columbia University who was certainly the most influential value investor of the 20th century. He proposed the following formula for the intrinsic value of stocks.Value = (EPS x (8.5 + 2g) x 4.4) / YEPS= trailing 12 month earnings per share8.5 = a reasonable price-to-earnings for a company with no growth in 1962g = a reasonable estimate of the 7 to 10 year growth rate for the firm4.4 = the average yield of AAA corporate bonds in 1962Y = the current yield on AAA corporate bondsThe Benjamin Graham books Security Analysis (1934) and The Intelligent Investor (1949) are considered basic reading for any serious value investor.Value of Value Investing

Value investors play a role in the financial stability and efficiency of a nation by performing deep analysis of firms and rewarding those who are delivering on earnings, financial management and corporate governance.| Overview: Value Investing | ||

Type | ||

Definition | The practice of selecting investments based on their intrinsic value. | |

Related Concepts | ||