Rush for the Exits

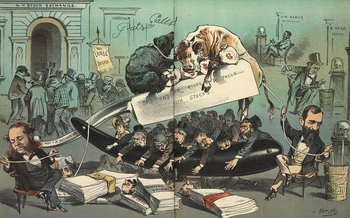

A long squeeze may occur due to irrational exuberance whereby investors have inflated expectations that fail to incorporate risk and the likelihood that a firm with superior performance in some area will revert to the mean. Irrational exuberance may be suddenly shattered by company news resulting in many investors losing faith in a firm at the same time. This results in a large number of sellers and few buyers triggering rapid price declines.Stop Losses

Investors may set stop losses that trigger an automatic sale of an security at a predefined price. This can trigger a large number of automatic trades at psychological price points that cause price declines that may trigger further stop losses.Margin

A long squeeze may be magnified by investors who are leveraged such that they are forced to sell. For example, an investor with a margin account may receive a margin call when a stock drops. This is a demand that cash be deposited or a security sold in order to meet the requirements of a margin loan.Short Selling

Price declines may attract short sellers looking to capitalize on the momentum of downward pressure in prices. In the worst case, large institutional investors may open up naked short trades against a security they believe has further to fall. This means that a broker is selling shares into the market that they do not own and have not borrowed from an investor.Panic Selling

An emotional response to price declines characterized by sudden feelings of fear and discomfort. A panicked investor may act erratically. For example, suddenly selling at a market price during a price slide, then suddenly buying when the price starts to recover and then selling again when the price resumes its downward momentum. This is extremely destructive behavior that is not compatible with the preservation of wealth.Capitulation

Capitulation is a final panic that characterizes the end of a long period of decline for a stock. For example, a once beloved technology company that falls from $60 to $8 a share may have a final sell off whereby the price declines to $5 in a single day. This is described as the complete abandonment of hope whereby news causes the firm's last supporters to flee. By definition, capitulation is the last in a long line of dramatic price declines. After this point, the stock may stabilize for a long period of time based on its low valuation. Alternatively, the stock may recover as confidence somehow returns or slowly decline towards the eventual failure of the company.Notes

A long squeeze can be halted by factors such as durable support for a firm whereby investors can remain confident in the face of a price slide based on the fundamental value of the firm. Other factors such as short covering and the entrance of value investors can also mitigate a long squeeze.Capitulation does not always occur and it is impossible to tell if a particular decline is a capitulation at the moment it occurs. In other words, capitulation only becomes clear in retrospect.| Overview: Long Squeeze | ||

Type | ||

Definition | A vicious cycle of selling in a stock whereby price declines trigger selling that triggers price declines that leads to more selling. | |

Related Concepts | ||