Mr. Market

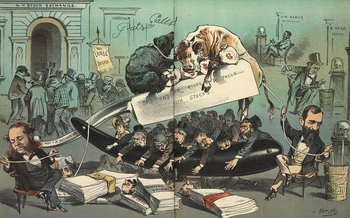

Graham suggests that investors view the market as an emotionally unstable partner, Mr. Market. Each business day, Mr. Market offers to buy your share of the business and sell you his share. When he is in a greedy mood he sets a high price. When he is in a fearful mood sets a low price.Implications

Benjamin Graham is known as the father of value investing. He suggests carefully valuing stocks and only buying when prices are below their intrinsic value.Graham recommends not allowing the mood swings of Mr. Market to sway your strategy. Nevertheless, if Mr. Market offers you irrationally low prices in a quality company, you might buy. If he offers you irrationally high prices for a position you hold as a long term investment, it may be advantageous to sell.The Mr. Market analogy suggests that the stock market isn't always efficient but prone to being moody and irrational. As such, a rational investor may go through periods where there isn't much to buy as prices swing wildly high. At other times, it may be difficult to sell as Mr. Market may set prices irrationally low. As such, the Mr. Market analogy is typically applied to a long term buy-and-hold strategy. It is also associated with highly disciplined valuation methods and buying below intrinsic value as a margin of safety.| Overview: Mr Market | ||

Type | Behavioral FinanceInvesting | |

Definition | An analogy that paints the stock market as a moody partner who occasionally offers irrational prices. | |

Related Concepts | ||