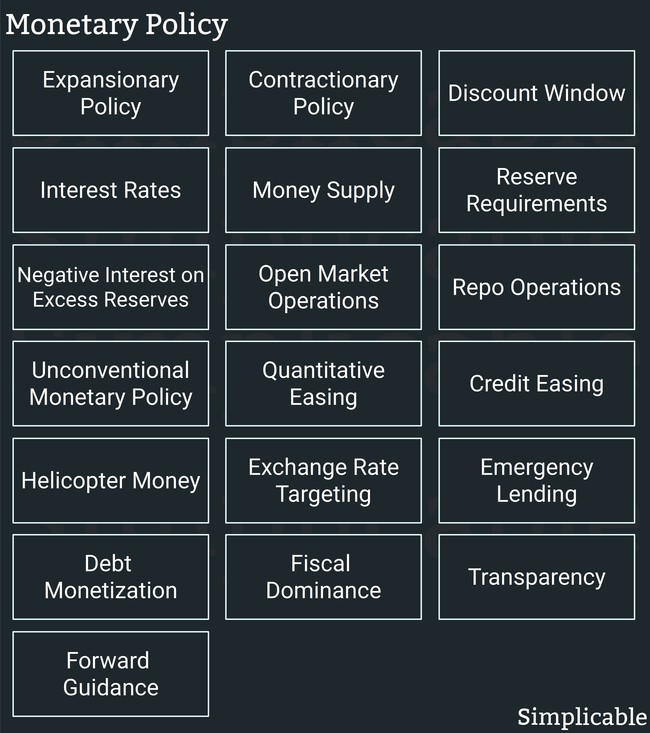

Expansionary Policy

Monetary policy that is designed to stimulate economic activity. For example, low interest rates will tend to increase business investment, increase consumption, reduce unemployment and increase inflation.Contractionary Policy

Policy that is designed to reduce excessive economic activity such as high inflation or speculative risk taking.Discount Window

A monetary authority such as a central bank lends money to financial institutions, usually on a short term basis, to cover liquidity short falls. This is known as the discount window and the interest rate on these loans is the discount rate. The discount window acts as a backstop to the financial system and the discount rate tends to influence other interest rates.Interest Rates

A monetary authority may set targets for foundational interest rates that are intended to influence all interest rates. For example, a central bank may set a target for the interest rate at which banks may lend their surplus reserves to other banks. This is known as the federal funds rate in the United States and is widely used to benchmark all interest rates. Low interest rates are expansionary and high interest rates are contractionary.Money Supply

Money supply is the amount of money both physical and digital that is created in a currency. For example, deposits held by commercial banks are part of the money supply. There are various ways to measure the money supply that may include elements such as currency, commercial bank deposits and central bank deposits. The money supply can be largely controlled by monetary authorities whereby they can increase the money supply as an expansionary policy or decrease it as a contractionary policy.Reserve Requirements

Reserve requirements is the amount of money that a bank must hold to cover its deposits. Monetary authorities control this and can change it to expand or contract the money supply. Low reserve requirements expand the money supply by increasing the amount that banks are allowed to lend out.Negative Interest on Excess Reserves

An extraordinary policy that charges banks a fee for holding more than their reserve requirements. This encourages banks to lend out cash as opposed to hording it and is typically a response to deflation or deleveraging whereby firms and individuals are saving cash and paying down debt in response to bleak economic expectations.Open Market Operations

A monetary authority can participate in markets to expand or contract the money supply. This can be accomplished by buying or selling government bonds.Repo Operations

A repo is a type of open market operation that uses agreements with commercial banks known as repurchase agreements to influence the money supply and interest rates. This involves selling a security, such as a government bond, to banks with an agreement to buy it back later at a higher price to temporarily reduce a bank's liquidity. It is also possible to do a reverse repo whereby a monetary authority buys a government bond from a bank and sells it back later at a lower price to temporarily increase the bank's liquidity. Both repos and reverse repos are mostly done to achieve target interest rates.Unconventional Monetary Policy

Unconventional monetary policy is a set of tools for influencing the economy when interest rates are already at or near zero. This includes credit easing, quantitative easing and helicopter money.Quantitative Easing

The term quantitative easing is typically applied to the large scale purchase of government bonds and other securities in the open market. This increases money supply and lowers interest rates by increasing the price of bonds.Credit Easing

Credit easing is an unconventional monetary policy that involves purchasing private sector assets such as the stocks and bonds of companies potentially using vehicles such as exchange traded funds. This sidesteps banks to directly fund firms and may be conducted in a deflationary environment where banks are reluctant and slow to lend. Taken too far, this results in the government owning large portions of the private sector and is likely to reduce economic efficiency by funding zombie firms and creating perverse incentives.Helicopter Money

Helicopter money is the process of expanding the money supply by directly giving money to the entire population of a nation. This can be used to increase bank deposits, consumption and investment.Exchange Rate Targeting

Targeting an exchange rate with a foreign currency and taking steps to achieve this target using monetary controls and by directly participating in foreign exchange markets. A low currency will stimulate exports and decrease imports in order to expand the domestic economy. However, it tends to be massively expensive to fight the market price of a currency and is viewed as a poor policy. Other governments are likely to view this as an anti-competitive and aggressive practice such that it can trigger a currency war. Monetary controls such as limiting overseas cash transfers are oppressive and decrease economic efficiency.Emergency Lending

Extraordinary lending to banks or other institutions that are considered "too big to fail" because they are part of the basic infrastructure of an economy. This is typically designed to prevent a systemic collapse. In order to prevent perverse incentives, this may involve a monetary authority temporarily taking ownership of firms to wipe out investors. In other words, emergency lending should not benefit those who created a large scale problem or risk.Debt Monetization

Debt monetization is the process of buying government bonds with cash created by a monetary authority and then simply canceling the bonds. This funds a government with newly created cash. This is associated with hyperinflation whereby a government creates a vicious cycle whereby it must create money to fund itself but the value of that money keeps declining due to money creation.Fiscal Dominance

Fiscal dominance is when a government is heavily indebted and spending beyond its revenues such that monetary policy is concerned with funding the government as opposed to goals such as economic growth, low unemployment and price stability.Transparency

Transparency is the degree to which a monetary authority publishes its positions, actions and agreements to the public. This is viewed as important to confidence in a currency and financial system.Forward Guidance

Communication is considered an important tool of monetary policy. As a monetary authority can create money and therefore has unlimited capacity, market participants are unlikely to bet against the targets of a large monetary authority. By communicating long term forward guidance or signaling changes a monetary authority can greatly influence the market independently of any transactions they execute.Monetary Policy vs Fiscal Policy

Monetary policy is control of money and interest rates. Fiscal policy is control of government spending and debt. These both have significant influence on the economy. It is considered important to strictly separate institutions that manage these two policies due to the risk of fiscal dominance. There is also an effort to keep monetary policy from being used as a political tool as this could cause great damage to an economy and nation.| Monetary Policy: Cheatsheet | ||

Definition | Control of money and lending by a government. | |

Expansionary Policy | Reduce interest rates.Increase money supply.Provide liquidity to banks.Make it costly for banks to horde cash (negative interest rates).Provide liquidity to firms.Provide liquidity to consumers.Reduce value of currency (foreign exchange rate).Emergency funds to rescue financial infrastructure.Target inflation to encourage spending and investment and discourage the hording of cash.Signal and communicate forward guidance that expansionary policy will continue into the future. | |

Contractionary Policy | Increase interest rates.Decrease the liquidity of commercial banks.Signal and communicate forward guidance that contractionary policy will continue into the future. | |

High Risk Policy | Debt monetization -- using the monetary authority to fund the government.Fiscal dominance -- targeting monetary policy to help the government manage its outsized debt as opposed to economic targets such as sustained growth and low unemployment.Political policy -- setting monetary policy for the short term gains of politicians while shipwrecking the economy. | |

Monetary Policy Objectives | Unemployment -- low rate, not so long that it triggers high inflation.Price stability -- healthy inflation that encourages consumption and investment, avoid high inflation, avoid deflation.Growth -- provide the liquidity to invest in capital and grow an economy. | |

Monetary Policy Tools | Discount Window -- overnight lending to banks.Target Interest Rate -- communicate target interest rates and achieve these by providing and subtracting liquidity from banks with techniques such as repos and reverse repos.Money Supply -- expand or contract the total quantity of currency that currently exists including all deposits.Reserve Requirements -- increase or decrease the amount of money commercial banks must hold to cover their deposits.Negative Interest on Excess Reserves -- charge a fee on the surplus reserves of banks to encourage them to lend.Open Market Operations -- buy and sell securities on the market.Repo Operations -- agreements to temporarily buy or sell securities to commercial banks. Often used to achieve target interest rates.Quantitative Easing -- buy securities to increase money supply.Credit Easing -- buy securities to increase the liquidity of firms.Helicopter Money -- provide money directly to residents of a nation.Emergency Funds -- buying critical financial infrastructure to prevent its collapse.Exchange Rate Targeting -- interfering with foreign exchange markets to influence imports and exports.Debt Monetization -- buying and canceling government debt.Forward Guidance -- committing to a sustained policy.Signaling -- indicating a change to policy. | |