Supply & Demand

As with other forms of capitalism, supply and demand set prices and production levels.Free Trade

Laissez-faire would allow for free trade between nations without trade barriers such as tariffs.Economic Bads

Unrestricted production of economic bads such as air pollution. Laissez-faire would be likely to harm quality of life a great deal as firms would be able to pollute recklessly.Consumer Protection

Without consumer protection laws, quality may be low and poor commercial practices may flourish. This may erode economic activity due to a lack of trust.Anti-Competitive Practices

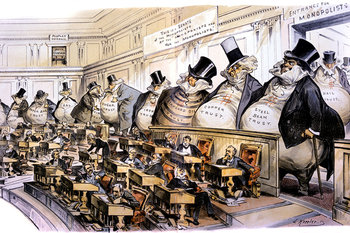

Regulations and government intervention are required to create and sustain competitive markets. In the absence of this, anti-competitive practices would prevail that would damage economic efficiency.Monopolies

Absolute economic freedom will quickly lead to large monopolies that prevent competition. Governments play a role in preventing monopolies and the threat of government intervention tends to moderate how aggressive monopolies become in taking advantage of their position.Finance

Without government regulation of banking and financial markets, trust in the system may be low and it would likely be difficult to finance businesses. For example, without regulation of stock markets investors would be regularly taken advantage of by firms such that investing might not be as popular.Taxation

Absolute economic freedom implies no taxation. Therefore, there might not be any way to fund things such as public education, healthcare and justice systems. It is quite likely that the workforce would be uneducated, unhealthy and live in unsafe conditions such that economic production would be primitive. For example, a knowledge economy would be unlikely without public education.Infrastructure

Without taxation it is likely there would be no shared public infrastructure. Private infrastructure would likely be controlled by monopolies such that prices may be high and access restricted. A lack of infrastructure and high infrastructure prices would decrease economic efficiency.Barriers to Entry

Barriers to entry would be created by existing competitors, particularly monopolies as opposed to government regulations. It can't be said that barriers to entry would necessarily be low as a monopoly could prevent new competition.Rights & Freedoms

Complete lack of regulations would create a chaotic environment that would be inefficient. For example, without a government to enforce property rights and economic freedoms civility would break down. For example, firms would borrow each others brands such that consumers would have no way to judge quality.Notes

Laissez-faire capitalism exists where society has completely broken down such as after a major conflict. It has never been implemented by a large society as it would be hopelessly destructive and inefficient for the reasons noted above. In practice, all developed countries heavily regulate markets to deliver efficiency, productivity, growth, quality, risk management and quality of life.A laissez-faire system would likely result in a monopoly that resembles a government in the sense that it has control of a society. In other words, it would result in an uncontrolled power struggle with a victor eventually emerging.| Overview: Laissez-Faire | ||

Type | ||

Definition | An economic system that is completely free of government intervention. | |

Related Concepts | ||