Example

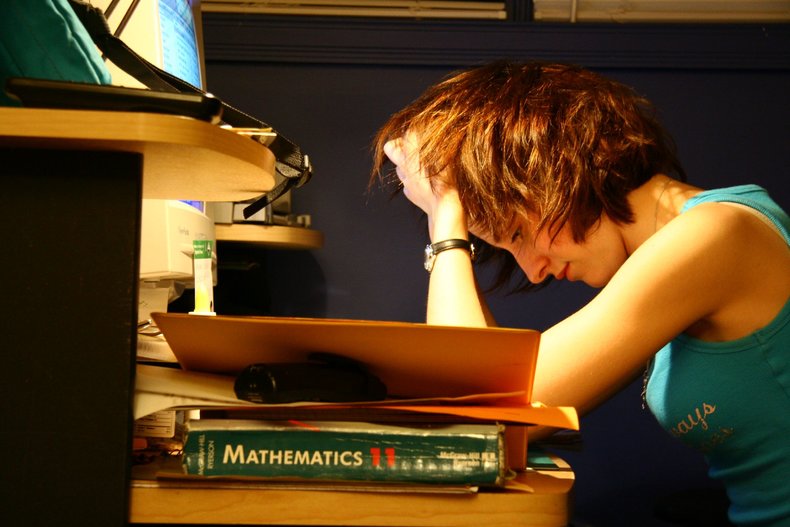

The tax code of a nation grows as law makers add regulations in response to requests from their supporters and constituency. The tax code may also grow in order to close loopholes. Companies and individuals tend to be creative when it comes to reducing taxes. As such, tax bodies tend to expand regulations as they encounter new avoidance techniques.Complex tax regulations are widely disliked and can may become an election issue in some countries. Despite the common desire for simple rules, they tend to be elusive.Downward Spiral

Complex regulations tend to lead to more complex regulations as loopholes need to be closed and exceptions need to be made.Virtuous Simplicity

Extraordinarily simple rules tend to stay simple over time. For example, a no-questions-asked return policy whereby a retailer will accept returns in 30 days for any reason tends to stay simple. Once you start adding exceptions and rules, they tend to escalate.It is theoretically possible to design tax rules that are progressive and almost paperwork free.| Overview: Ease Of Doing Business | ||

Type | Quality Of LifeEase Of Doing Business | |

Definition | The tendency for policies, procedures, rules and regulations to become more complex with time. | |

Related Concepts | ||