|

| |

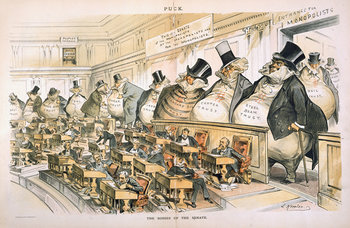

Insider trading is the trading of a company's stock or other securities such as bonds based on material information that is not public knowledge. For example, an employee who knows that a firm is about to be acquired who purchases the stock before a press release causes the stock to go up.Markets that fail to prevent insider trading may be viewed as unfair by investors. This makes it more difficult for firms to raise money and can damage an economy. In most jurisdictions, insider trading is tightly regulated including the requirement that officers, directors and major beneficial owners publicly report their trades. In many cases, an insider trade is considered fraudulent as a violation of fiduciary duty.

Third PartiesInsider trading laws may extend to people who aren't employed by a company such as friends and family who receive material information from insiders that isn't public knowledge.MisappropriationMisappropriation is a similar concept to insider trading that is also regulated in many jurisdictions. It occurs when any stock is traded based on material non-public information you receive from your employer. For example, an employee of a law firm who personally profits from confidential information about a merger or acquisition related to a client.|

Type | | Definition | The trading of a company's stock or other securities such as bonds based on material information that is not public knowledge. | Related Concepts | |

Next: Information Advantage

Business Ethics

This is the complete list of articles we have written about business ethics.

If you enjoyed this page, please consider bookmarking Simplicable.

© 2010-2023 Simplicable. All Rights Reserved. Reproduction of materials found on this site, in any form, without explicit permission is prohibited.

View credits & copyrights or citation information for this page.

|