Mergers & Acquisitions

A large Germany cookie company acquires a smaller Italian cookie company for cash. The amount of cash transferred for the acquisition can be viewed as a foreign direct investment from Germany to Italy.Facilities

An American technology company builds and operates a data center in Canada. This is a foreign direct investment from America to Canada.Manufacturing

A Canadian sporting goods manufacturer builds a factory in Thailand.Sales Office

A French software company opens a sales office in Brazil to reach the Brazilian market with their services.Retail

A Japanese fashion brand opens a retail location in London.Logistics

A Czech furniture company opens a warehouse in Rotterdam.Administration

An American electronics manufacturer opens a satellite office in China to procure parts and manage suppliers.Services

An American bank opens a customer service center in India to serve American customers.Horizontal

Horizontal foreign direct investment occurs when a firm replicates its entire organization in multiple countries. For example, a Japanese ecommerce company that builds out an American ecommerce company with administration, sourcing, logistics and data centers all based in America.Joint Venture

A German and Japanese train company form a joint venture to assemble high speed trains in Japan. The German portion of this investment can be viewed as foreign direct investment from Germany to Japan.Research & Development

An Dutch information technology company opens a research and development center in India.Foreign Investment vs Foreign Direct Investment

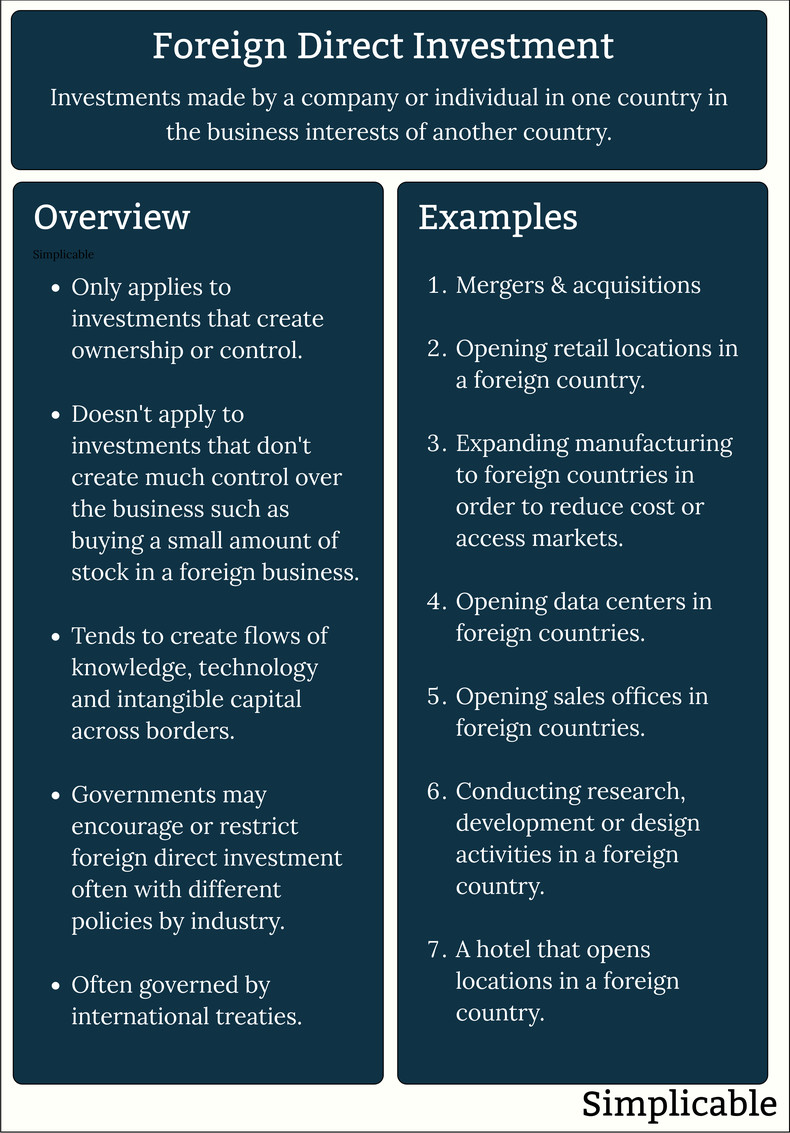

The difference between foreign investment and foreign direct investment is that direct investors control the management of the organization accepting the investment. This can be partial control but must be significant control. For example, an investor who buys 10% of a company does not "control" it simply by voting with their shares. However, a firm with a 10% interest in a joint venture might control it by placing their own management teams in the firm.Summary

Foreign direct investment is an investment by a company or individual in one country in the business interests of another country. This only applies to investments that create ownership or control.

Notes

Generally speaking, nations welcome and encourage foreign direct investment because it creates jobs and tax revenue.| Overview: Foreign Direct Investment | ||

Type | ||

Definition | An investment by a firm from one country in a business that it controls in another country. | |

Related Concepts | ||