Loss Aversion

A preference for situations where losses are unlikely. For example, a federally insured savings account as opposed to stocks and bonds that can fluctuate in value. This may neglect the risk of inflation as an interest rate in a guaranteed savings account is often less than the inflation rate.Uncertainty Avoidance

Uncertainty is the cause of all risk. In other words, if you could predict the future with certainty you would never choose a path that leads to failure. As such, risk aversion is associated with a preference with choices that are familiar, known and well-documented. For example, risk-adverse customers may have a preference for products that are marketed with in-depth information including details of design, construction, functionality, performance, specifications and customer support.Resistance to Change

A preference for stability that manifests as resistance to changes that are perceived as a threat to the status quo. For example, risk-adverse employees may attempt to derail a project that will dramatically change processes, procedures and tools.Incrementalism

A preference for incremental change such as continuous improvement. Risk-adverse individuals prefer a slow and steady pace of change with much planning and testing such that nothing is likely to go wrong. This can neglect risks related to being too cautious such as competitive risks in an industry that is rapidly changing.Pessimism

Generally speaking, optimism is associated with risk taking and pessimism with risk-aversion. This is because a pessimist will generally estimate higher risk probabilities than an optimist. Where a pessimist sees a 70% chance of failure, an optimist may see a 5% chance.Defeatism

Defeatism is when pessimism becomes a performance problem such that an individual doesn't exert effort and care in their work because they feel failure is inevitable. Risk-adverse individuals may have low motivation in an environment of aggressive risk taking as they feel that strategy is reckless and failures too frequent.Overthinking

Risk aversion can manifest itself as needless complexity. For example, risk-adverse individuals may consider low probability or low impact risks in their decision making processes that lead to a process of overthinking.Minimax Criterion

A minimax criterion is the choice from a set of options that minimizes the chance of a high impact risk. For example, a risk-adverse individual may buy a more expensive airline ticket on an airline or aircraft they perceive as safer.Perfectionism

Aversion to the risk of criticism or failure can drive an individual to perfect their work. This can be expensive as the pareto principle suggests that 80% of value is created within the first 20% of effort. For example, a project manager may be able to come up with a reasonable project plan in 2 days and a somewhat better project plan in 20 days.Summary

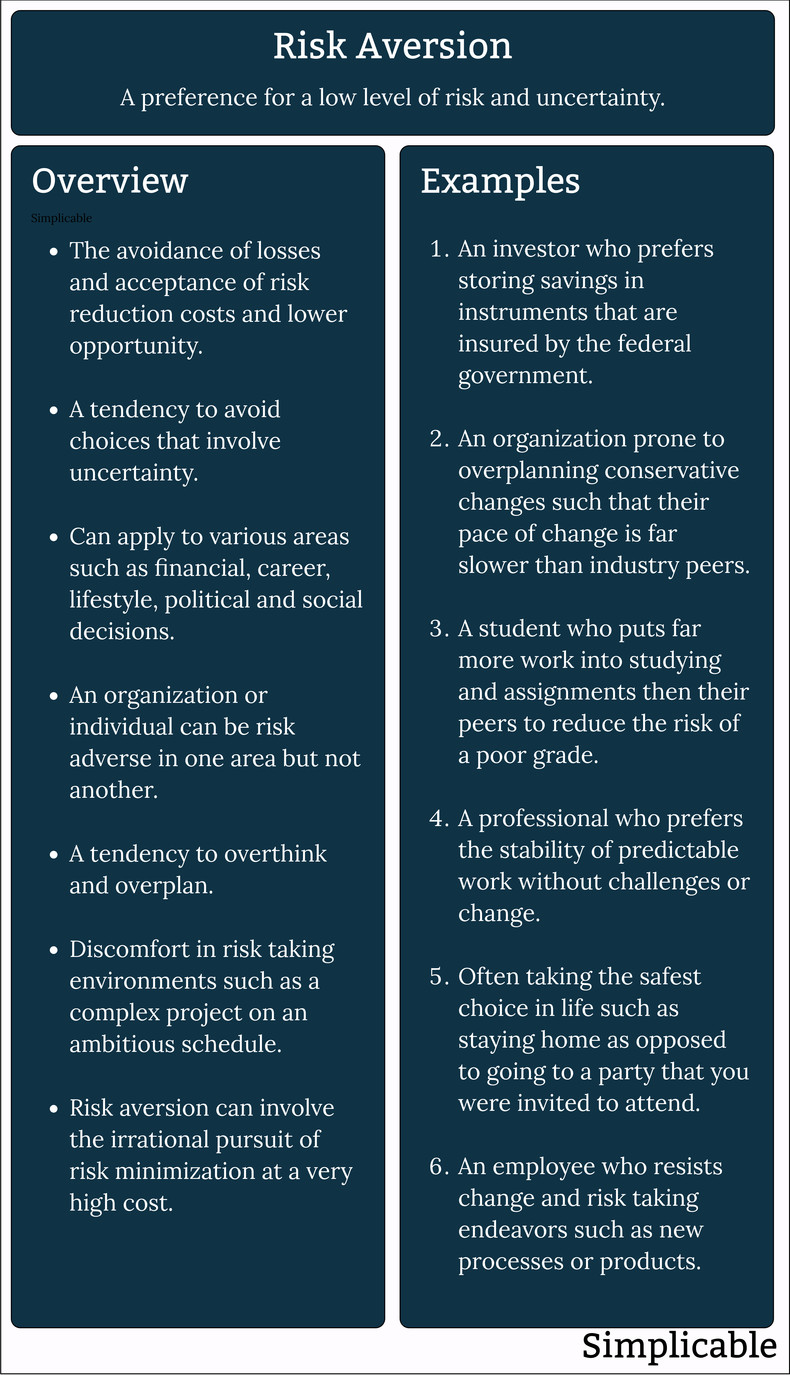

The following is a basic overview of risk aversion with additional examples.

| Overview: Risk Aversion | ||

Type | ||

Definition | A low tolerance for risk taking. | |

Related Concepts | ||