Time

The amount of time realistically available to solve a problem. For example, an individual may only have a few minutes to consider a stock trade.Tractability

The inherent difficulty of a problem. For example, a stock trade may involve hundreds of variables and great uncertainty such that it is not possible for an individual to determine an optimal decision in a few minutes.Logical Omniscience

In order to be fully rational, an individual needs to know all logical truths, accept all logical truths and apply all logical truths to problems. Likewise, individuals would need to be aware of all known fallacies and be able to self-correct their logic. This is all exceedingly unlikely. For example, a research who spends six months developing a model to make an economic decision may still come up short whereby their model is later shown to have logical faults. It is therefore awfully optimistic to think that all individuals are somehow producing perfect logic in the minutes available to them to make a decision.Cognitive Limitations

Cognitive limitations such as an inability to perform complex calculus in your head. It is common for economic models to calculate approximations with complex math and then assume that individuals will arrive at the same answer because they are "rational." This simply doesn't match the realities of how people think.Unknown Unknowns

In many cases, individuals are fully unaware of important factors that influence the quality of their decisions. For example, an individual who buys a stock based on its earnings and price who is fully unaware of concepts such as default risk, cost of capital and return on capital that would indicate the stock is a high risk investment.Information Asymmetry

The real world is characterized by imperfect information whereby one agent may know more than another agent. This breaks models that assume each agent acts rationally on the same information. For example, a seller of a house generally knows more about the house than the buyer.Heuristics

Agents commonly use a heuristic or rule of thumb to vastly simplify decisions. These are based on rational thought of limited scope that may be extremely suboptimal. For example, an investor who never buys a stock with a PE over 22 or a company that has debt larger than its one year revenue. This may be somewhat rational but will be suboptimal because it doesn't consider dozens or perhaps hundreds of variables that impact the likely performance of a stock.Emotion

In practice, people act without rational thought based on emotion. For example, an investor who suddenly sells their entire portfolio because the market is down and they experience a sudden sense of panic.Cognitive Biases

Rational thought is commonly clouded by cognitive biases that are fully irrational.Overview

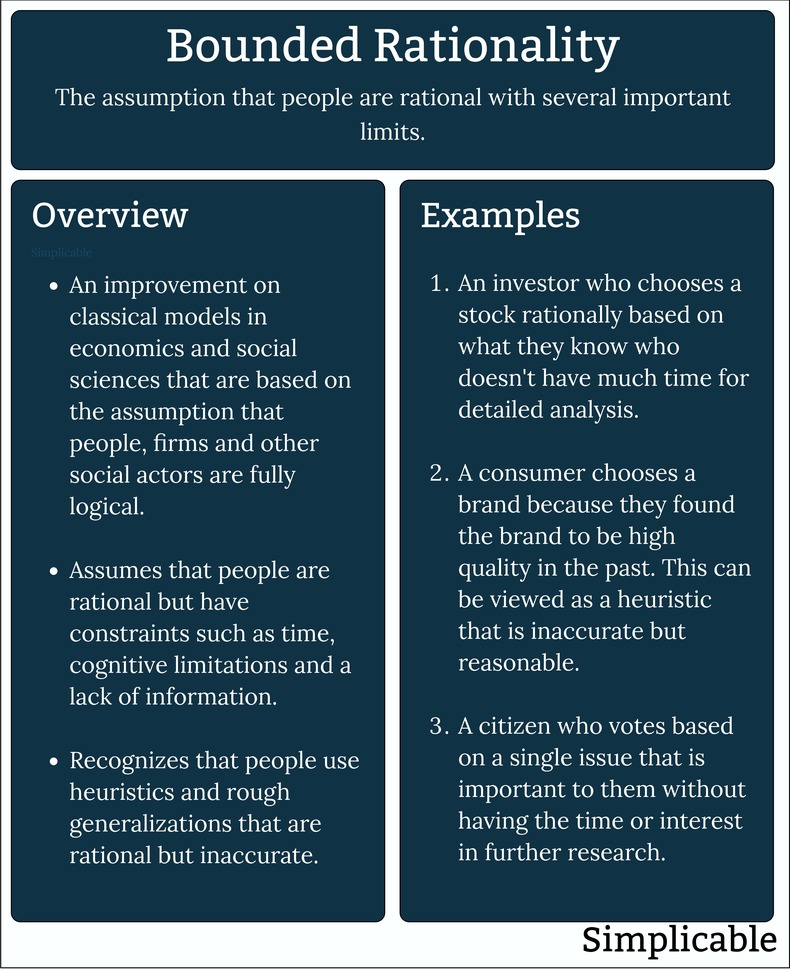

Bounded rationality is the assumption that people and other social actors such as firms are mostly logical but face constraints such as time, expertise and a lack of information. This is an improvement on classical models in areas such as economics that assume social entities are fully logical.

| Summary: Bounded Rationality | ||

Type | ||

Definition | The idea that humans are somewhat rational with several important limits. | |

Related Concepts | ||